Recently, the popularity of investing money in gold has increased. It is believed that this method is the most reliable in conditions of the country's economic crisis. Therefore, many businessmen choose bullion as an investment item. An ingot of gold or other precious metal has its own manufacturing characteristics, as well as rules for purchase and sale. Therefore, before starting a trading operation, you need to know all the nuances - this will help you make money on such investments.

Gold bank bars

There are other precious metals besides gold that are produced in bullion. In encyclopedic definitions, gold bullion is a form of storing metal for later transformation. But now no one transforms metal into this form, it is simply stored for many years, since casting such a form is not difficult. In addition, the precious metal in its pure form is soft, so the form of its storage should be as simple as possible to avoid deformation. You should not handle the ingot without a case, as it can easily be bent and leave imprints.

In order to properly purchase a gold bar, you need to familiarize yourself with the country’s requirements regarding the production of bars. And also understand their varieties and buy only from certified banks.

Bullions are produced either by refineries or foreign organizations in accordance with the requirements of the London Precious Metals Association. All goods must have documents confirming the authenticity of the origin of the gold. If the documents do not correspond to the gold bar, it is considered counterfeit, and when selling such a bar, the seller becomes subject to legal liability.

If a quality discrepancy is detected at the ingot manufacturing stage, the product is sent to a refinery for melting. This process is under control - compliance with standards and requirements is maintained, for example, GOST in Russia. Therefore, there is no need to doubt the quality of the product offered by the selling bank. Some gold bars are exported, where they also check their compliance with international quality standards.

In addition, not all banks are licensed to sell gold. If you plan to subsequently sell the bullion, ask other banks in advance if they accept gold bullion, since not all institutions are ready to buy precious metal bullion from another bank. Also, inquire about the interest rates and rate of purchase of gold by the bank.

Products of Russian refineries

They are classified according to different criteria:

- weight;

- form;

- manufacturer;

- sample or quantitative indicator of the gold content in the product;

- accompanying documents or quality certificates.

Among the most familiar to the average person are measured and standard ones, as well as with branded symbols. Let's talk about them.

Measured

This is the name for ingots produced by Russian or international refineries strictly in accordance with the standard - GOST R 51572-2000:

- 99.9% – pure gold content;

- up to 1,000 g – weight (1, 5, 10, 20, 50, 100, 250, 500 and 1,000 g);

- sizes are different.

Pixabay/HamiltonLeen

They are intended for individuals and are very popular among them. There are many of them on the market: they are sold and bought, presented in banks or jewelry stores. And the more a 999 fine bar weighs, the more expensive it is.

Three different technologies for their production are known:

- Stamped ones marked SSHZ are the most expensive.

- Cast ones, weighing up to a kilogram, with the designation SLZ - are cheaper.

- Powder - do not comply with Russian standards.

Screenshot GOST R 51572-2000

But not only its designation is applied to the ingot, but also the following information:

- oval stamp “Russia”;

- weight;

- the inscription "Gold";

- try;

- manufacturer's brand.

This is a mandatory requirement of GOST.

Screen marking of a measuring ingot

But, before information about it is stamped on the product, the sample is tested in the chemical laboratory of the plant. If the gold is not pure enough, it is sent for reprocessing. Without the final approval of the chemists, the ingot will not be branded.

All inscriptions are placed on the title side of the product. They must be legible without corrections or merged letters. The presence of any defect reduces the cost.

Each ingot is accompanied by a manufacturer's certificate (GOST R 51572-2000, clause 4.4.2).

Source: GOST R 51572-2000, Appendix B

Have you ever bought gold bullion?

Yes

No

Standard

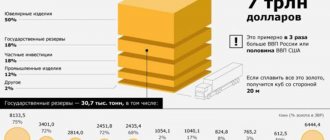

They are also produced at refineries and labeled strictly according to state standards. These are banking metal ingots that meet all quality standards and requirements. They are intended to be raw materials for jewelry workshops and factories; they are not used in everyday life. And therefore they do not differ in variety. Such bars contain Russia's gold reserves.

Photo: in the vault of the Central Bank of the Russian Federation

According to Kommersant, at the end of 2021, reserves of precious metals in Russian banks reached a record value of more than 92 tons. This is the maximum over the last 5 years.

Reference! At VTB at the end of the year - 54 tons, Sberbank - 17 tons. At Sovcombank, FC Otkritie, Gazprombank and the National Clearing Center - from 1 to 5 tons.

“Purchases are usually made at the end of the mining season, then the gold is gradually sold to consumers and the Central Bank.

Now it is already less than at the beginning of the year" Sberbank

Requirements for standard products are regulated by GOST 28058-89:

- The mass fraction of gold must be at least 99.99%.

- Shape – regular truncated pyramid with dimensions, mm:

- larger base – length 254±5 and width 88±5;

- smaller base – length 229±5 and width 59±5;

- height – 35±2.

- The weight of a standard gold bar in kg is from 11 to 13.3.

- The surface is free of stains and/or damage.

- The depth of the cleaned areas is no more than 1 mm.

- Concavity – no more than 5 mm.

Markings are applied to the larger side of each copy in accordance with GOST requirements. In addition, it must have a standard certificate, just like a measured gold bar.

Find out all about existing samples of the yellow metal.

With branding

Only very successful companies allow themselves such business gifts to their partners or even employees. A VIP gift can be either a single bar or a whole set. Their weight, in accordance with international standards, varies from 1 g to 1 kg.

Photo: Pixabay/flaart

Interesting! LEGO gives its employees who have worked for the company for 25 years a 25.65 g bar.

Bullions of precious metals

1. What designations must be present on the ingot.

In accordance with current standards for precious metals, manufacturing plants typically apply the following markings to bars:

- "RUSSIA"

- nominal weight of the ingot, g

- name of metal

- metal grade (for standard ingots)

- mass fraction of precious metal contained in the ingot in samples

- manufacturer's trademark

- number (code) of the ingot.

It is also allowed to include the details of the bullion in English. The ingot may bear the trademark of the customer (credit organization, etc.) or other symbols agreed upon with the manufacturer.

2. Which bank departments carry out transactions with precious metal bars in Moscow?

A list of bank offices selling and purchasing bullion in Moscow is available on the map of branches and ATMs

3. Where can I find out the prices for buying and selling precious metal bars in Moscow?

On the bank's website in the quotes archive

4. Is it possible to purchase gold bars weighing more than 1000g?

Yes. You can purchase standard ingots weighing from 11000 g to 13300 g. Check the availability of ingots by calling sales offices.

5. I have a stamped gold bar weighing 20 grams, but due to “careless” handling, scratches have appeared on it. Can the bank buy it and at what price?

Sberbank purchases precious metal bars from individuals in both excellent and satisfactory condition at current bank prices presented on the website and in the bank’s branches (see answer to question 3). The assignment of an ingot to one or another condition category is carried out by bank specialists after its inspection.

6. How to determine the manufacturer of the ingot?

The manufacturer is usually indicated in the certificate. It can also be identified by the trademark both on the certificate and on the bar itself. In addition, each manufacturer uses its own ingot numbering system. Those. You can also determine the manufacturer by the ingot number. For example, the letters NV in the ingot number indicate that this ingot was produced at the Novosibirsk Refinery, Kr - at the Krasnoyarsk Non-Ferrous Metals Plant, etc.

7. I purchased a 20 gram gold bar from one of the Moscow commercial banks. Can I sell it to Sberbank now?

Sberbank of Russia purchases precious metal bars in both excellent and satisfactory condition at the corresponding quotes on the date of the transaction. At the same time, ingots in excellent condition are considered to be ingots that do not have external damage if they have intact certificates (passports) from the manufacturer. And ingots of satisfactory condition are ingots that have surface damage (scratches, abrasions, etc.), logos of other credit institutions and/or that have damage to the manufacturer’s certificate (passport) (tears or part of it is torn off, there are inscriptions, stains, etc. .p., affecting the viewing of the text), logos of other credit institutions on the certificate.

You can conduct transactions with bullion of precious metals by sending it to:

Ingot standards for the whole world

A well-known example of precious metal bullion is the London Good Delivery, which means “safe bet” in English. It has been approved by the LBMA (London Bullion Markets Association) and LPPM (London Palladium and Platinum Market).

Photo: Pixabay/flaart

In the vaults of the central banks of most countries there are classic Good Delivery bars. Their traditional weight is 400 troy ounces, or 12.4 kg. And they are traded in all the main international centers for the sale of this precious metal: London, New York, Zurich, Hong Kong, Sydney and Tokyo.

Table 1. Requirements for 995 gold bars

| Names of standards | Units | Values |

| Weight | t oz | 350-450 |

| G | 10 886-13 754 | |

| Dimensions | mm | |

| length of the larger base | 250 (+/- 40) | |

| width of larger base | 70 (+/- 15) | |

| thickness (height) | 35 (+/- 10) |

Source: inzoloto

Acceptable beam bevels: 7-15% in length, 15-30% in width.

The following is imprinted on the outer surface:

- manufacturer's mark;

- weight;

- purity (sample);

- serial number;

- year of creation.

What are gold bars and how to use them?

Gold bars are 999.9 pure gold bars weighing 5, 10, 20 and 50 grams in special protective packaging. The packaging of gold bars serves as a certificate and has its own serial number.

What types of gold bars are there?

Gold bars are made of 999.9 pure gold weighing 5, 10, 20, and 50 grams.

Measured ingots are put into circulation in special protective packaging, which was developed jointly with the Italian one.

The ingot and its packaging have the same serial number. The packaging has 3 types of protective elements:

Is it possible to open the protective packaging?

If you plan to sell the gold bar in the future, then you should not open the protective packaging. The packaging has several protective elements - a cryptoprint (appears on the surface if the package has been opened), a protective membrane (changes color when opened). In addition, each bar is numbered, and there is a QR code on the packaging.

Where to store gold bars?

It is important to think about the safety of the ingot, since even one scratch can greatly reduce the price of the ingot. For example, if it is damaged, then upon purchase the bank will conduct a technical examination to find out a new price. The bars are sold in protective packaging, so they can be stored at home or in banks - you can rent individual bank cells (a cell from 125 mm is suitable for bars).

Where can you buy gold bars?

You can buy gold bars in banks. A complete list with addresses can be found on the Central Bank website.

How much do gold bars cost?

Prices for gold bars can change several times a week - the current price can also be found on the website of the Central Bank. You can buy gold bars in cash and non-cash form.

How and to whom can you sell gold bars?

Bullion can only be sold to banks.

The cost of repurchase of a measured gold bar is calculated based on the price of one gram of precious metal on the date of its delivery and the discount to this price, according to the following formula:

Here:

∑ ― the cost of repurchase of a measured gold bar for payment in sums;

V is the weight of the measured gold bar in grams;

PG/UZB - price for one gram of precious metal, established by the Central Bank in soums;

D is the discount amount established by the Central Bank (in percentage).

Let's look at an example:

Calculation of the cost as of December 25, 2021 for the buyback of a gold bar weighing 5 grams:

- If the packaging is intact (discount amount is 1%)

Buyback cost ═

- In case of violation of the integrity of the packaging or non-compliance with current technical requirements (discount amount - 2%)

Buyback cost ═

Here,

- weight of a gold bar - 5 grams;

- price of one gram of gold ═

- gold price on the world market (LBMA fixing) – $1,875.00/troy ounce;

- the equivalent of one troy ounce in metric grams = 31.1035 g;

- exchange rate of the Central Bank to 1 US dollar – 10,473.77 soums.

If the protective packaging of the bullion is opened or there is damage, then the bank carries out a technical examination (within 20 working days), and payment is made after verification.

The procedure for purchasing and selling bullion

To purchase bullion bars, individuals or legal entities contact the bank and make payment in cash or non-cash form.

On the same day, the buyer is given a measured ingot with a seal, along with a certificate confirming the technical properties. Each ingot has an identification serial number, which is indicated on the ingot and on the certificate.

To sell (return) a measuring ingot that has a complete seal and certificate, the owner of the ingot also contacts the bank. On the same day, the bank makes a settlement with him for the measuring ingot.

Is it possible to export gold bars abroad?

Gold bars can be exported to individuals abroad without restrictions, only if they have the appropriate certificates and with the mandatory completion of a passenger customs declaration in case of exceeding the norm established by law (if the value of the bars exceeds $5,000).

Bank gold bars

Gold bars produced in our country have a purity of at least 999.5. Depending on the sample and weight nomenclature, they are measured and standard. The manufacturer's mark must be present on the front side.

Measured ingots have a mass from 1 to 1000 grams. The minimum content of pure metal in them is 99.99%. Bankers call 999.9 fine bars “four nines”, and 999.99 fine bars are called “five nines”. GOST R 51572-2000 is established for measured gold bars.

Standard ingots are produced weighing from 11 to 13.3 kg and a fineness of at least 999.5. Ingots of this type are subject to the interstate standard (GOST 28058-89). A standard gold bar is made in the shape of a regular truncated pyramid. The manufacturing plant has the right to produce standard ingots of a different shape and weight.

According to the manufacturing method, gold bars are either cast or stamped.

Cast bars are made by pouring molten gold into prepared molds where the precious metal cools and becomes solid. Both measured (500 g and more) and standard ingots are produced by casting.

Stamped bars are more liquid in the banking industry because they have a perfectly smooth surface and perfect shape. However, they are more expensive to produce because stamping requires high-tech equipment. Stamped ingots are produced only in dimensional quantities - weighing no more than 500 g.

There are also powder ingots not provided for by Russian standards. They are made electrolytically from gold powder. Powdered ingots are practically never found in banks in our country.

Special types of ingots:

ChipGold bars resemble a credit card and weigh between 1 and 20 grams. ChipGold is sold in sealed and certified packaging.

Kinebar bars contain a special kinegram, which is used as a protective element and at the same time creates visual appeal. A Kinegram is a metallized element with the effect of a moving three-dimensional pattern, pressed into a gold bar. Kinebar bars are a registered trademark of the largest bank in Switzerland, UBSAG.

CombiBar bars are produced in the form of a chocolate bar and are manufactured in Switzerland. The main feature of such a gold bar is that it can easily be broken by hand into even slices weighing 1 gram. CombiBar gold slices can be used as an alternative means of payment or simply given as a gift to someone. Valcambi produces slab bars not only from gold, but also from other precious metals: silver, palladium and platinum.

← Investment coins↑ Information about goldUses of platinum →