How to legally formalize the purchase of jewelry from hand and in retail stores (individual entrepreneurs and LLCs)

The question of what organizational and legal form a legal entity should have, Article 48 of the Civil Code of the Russian Federation, does not play a fundamental role here. You can also register as an individual entrepreneur. There are many nuances in this activity. Read the following Rules for purchasing jewelry and other household products made of precious metals and precious stones and scrap of such products from citizens

For a more complete consultation, you need to contact a lawyer personally.

The main thing is to comply with the requirements of the Federal Law of March 26, 1998 N 41-FZ (as amended on August 2, 2019) “On Precious Metals and Precious Stones” (as amended and supplemented, entered into force from October 1, 2019)

To conduct business in buying jewelry, you will need a license under Article 15.1 of this law.

The procedure for purchasing jewelry from the population is determined by

Decree of the Government of the Russian Federation of June 7, 2001 N 444

“On approval of the Rules for the purchase from citizens of jewelry and other household products made of precious metals and precious stones and scrap of such products”

1. These Rules establish the procedure for purchasing by organizations, regardless of organizational and legal form, and individual entrepreneurs (hereinafter referred to as the buyer) from citizens (hereinafter referred to as the deliverer) in their ownership of jewelry and other household products made of precious metals and precious stones and scrap of such products .

2. Lost power.

See text of paragraph 2

3. The buyer must have the necessary premises, equipment, inventory and a security system for the premises, ensure, in accordance with established requirements, registration, accounting, storage of purchased valuables and the necessary conditions for servicing the deliverers, as well as comply with the mandatory requirements of state standards, environmental, sanitary and epidemiological, hygienic, fire safety and other rules and regulations.

4. To carry out operations for receiving and testing valuables, the buyer must have:

a) weighing and other relevant equipment, as well as the necessary tools;

b) reagents necessary to determine the name and sample of precious metals in products and scrap.

5. The purchasing organization must have experts with appropriate qualifications in matters of examination and assessment of values.

An individual entrepreneur-buyer must have the necessary qualifications in matters of examination and assessment of values.

6. The buyer is obliged to bring to the attention of the deliverer:

a) the corporate name (name) of your organization, its location and operating hours, an individual entrepreneur - information about state registration and the name of the body that registered it;

b) has become invalid;

See the text of subparagraph b of paragraph 6

c) information about documents establishing requirements for the marking of valuables, their acceptance and registration;

d) these Rules;

e) information about the bodies monitoring compliance with these Rules.

This information is placed in convenient places for reference.

7. Acceptance of valuables for purchase is carried out regardless of the presence of manufacturers’ birthday names and imprints of state hallmarks on them, and commemorative and anniversary (personalized) medals - upon presentation by the deliverer of the appropriate certificates for the right to own such medals.

8. Settlements with donors of valuables are made on a contractual basis.

9. Not subject to purchase:

a) rough diamonds and semi-finished products;

b) precious metals in native and refined form, as well as in raw materials, alloys, semi-finished products, industrial products, chemical compounds and industrial and consumer waste;

c) semi-finished products for jewelry and dental prosthetics (except for crowns and discs);

d) products for industrial and technical purposes made of gold, platinum, palladium and silver (plates, wire, contacts, laboratory glassware, etc.);

e) precious stones - rubies, sapphires, emeralds, alexandrites, as well as natural pearls in their raw form;

f) orders and medals, except commemorative and anniversary (nominal) ones, containing precious metals;

g) products containing precious metals and precious stones and withdrawn from civil circulation or limited in circulation (cold steel, firearms with decoration, etc.).

10. All operations related to the purchase of valuables (determining the names of precious metals and precious stones, determining the sample of precious metal, weighing, removing pins, etc.) must be carried out in the presence of the deliverer using methods that do not violate the integrity of the valuables.

11. Weighing of values is carried out with accuracy:

products made of gold, platinum and palladium - up to 0.01 grams;

silver products - up to 0.1 grams;

products made of precious stones without a frame - up to 0.01 carats.

The weight of precious stones that cannot be set from products when purchased or that are impractical to be set from products is determined by instruments with an accuracy of 0.1 carats.

The deliverer must be given the opportunity to verify the correctness of the determination of the mass of the valuables handed over to him. The buyer is responsible for the correct assessment of accepted values in accordance with the legislation of the Russian Federation.

12. If the deliverer agrees with the assessment of the accepted values, the buyer issues to the deliverer for payment of the amount due to him a receipt in 2 copies, signed by the buyer and the deliverer. After paying the amount due to the deliverer, he is given 1 copy of the receipt with the “paid” stamp.

13. The receipt shall indicate:

a) the name of the organization or the surname and initials of the individual entrepreneur - buyer;

b) the surname and initials of the deliverer, indicating the details of the document proving his identity;

c) the name of the product, parts of the product and their quantity, description of the birthday stamp (for pre-revolutionary products - the master’s birthday stamp) and the hallmark (for imported products - the import stamp stamp);

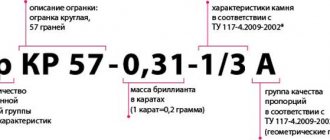

d) name of precious metals, fineness, weight, contract price per gram and cost;

e) name of precious stones, their quantity and weight, contract price per carat, cost, including in relation to:

large diamonds (from one carat and above), medium ones (from 0.30 to 0.99 carats), emeralds, sapphires, rubies, alexandrites - also their size and weight group, color and purity group;

rose cut diamonds, small diamonds (up to 0.29 carats) and simplified cut diamonds - also their color and clarity group;

natural and cultured pearls - the number of pearls and their weight;

f) total weight of the product;

g) the amount to be paid to the deliverer of valuables.

14. Accepted valuables cannot be returned after payment.

15. Monitoring of compliance with these Rules is carried out by federal executive authorities authorized in accordance with the legislation of the Russian Federation and their territorial bodies.

Article 2 of this law states: Precious metals and precious stones acquired in the manner established by the legislation of the Russian Federation may be in federal property, the property of constituent entities of the Russian Federation, municipal property, as well as in the property of legal entities and individuals. Owners of precious metals and precious stones exercise their right of ownership of precious metals and precious stones in accordance with this Federal Law, the Civil Code of the Russian Federation,

Article 15.1. Licensing of activities for processing (processing) scrap and waste of precious metals and activities for the purchase from individuals of jewelry and other products made of precious metals and precious stones, scrap of such products

(introduced by Federal Law dated 02.08.2019 N 282-FZ)

Activities for processing (processing) scrap and waste of precious metals and activities for the purchase from individuals of jewelry and other products made of precious metals and precious stones, scrap of such products are subject to licensing in accordance with the legislation of the Russian Federation on licensing of certain types of activities.

Call

Did the answer help you? Yes No

Vladimir Poroshin: Organization of a buying point in a jewelry store

12/04/2016 Assay supervision 10311

Vladimir Poroshin

Telephone:

Email:

Website: Go

Consultant at DRAGMETCONSALT LLC

Other expert publications:

- Notes from the head of the KRO: Marking of precious metals, precious stones and jewelry

- Notes from the head of KRO-17: Retail jewelry trade and illiquid assets

- Notes from the head of the KRO. Jewelry retail and statistical reporting.

- Notes from the head of the KRO: Organization of the work of a retail jewelry store

- Notes from the head of the KRO: Organization of procurement work

It's no secret that the global financial crises have made adjustments to Russian jewelry production and jewelry trade. The purchasing power of the population has decreased. Jewelry is not considered an essential item, therefore, under conditions of forced austerity, the population first of all cuts costs on all non-essential goods.

In the face of declining consumer activity, jewelry stores are looking for new forms of attracting customers. One of these forms is the organization in a store of the purchase of jewelry made of precious metals and precious stones and scrap of such products. A more attractive service for clients is also very popular - trade-in, i.e. netting system. When a customer decides to purchase a new piece of jewelry, the jewelry store employees evaluate his old piece and calculate how much he will have to pay for a new one.

As a consultant, I often get asked questions like this:

— We want to open an exchange fund at a retail outlet, i.e. exchange of scrap for a finished product with additional payment for the work. Products for exchange will be procured from third-party manufacturers under a contract. Do we have the right to provide such services to individuals?

— Can purchases be carried out using strict reporting forms or can they be carried out under purchase agreements?

— Do I need to submit lists of purchase clients to the tax office?

— If, according to a tolling scheme, you scrap old products from the counter, do you need to draw up a report on them for reporting?

— We are additionally engaged in buying and exchanging old jewelry for new ones. Do we need to fill out forms for individuals selling scrap gold?

— If we accept gold for exchange, do we need to submit reports?

I'll try to answer these questions.

Selling a new piece of jewelry with the value of the old one set off, or exchanging an old piece of jewelry for a new one is still considered a purchase.

For all such activities, the following OKVED codes are needed (I remind you that from July 2021, the coding of types of economic activities is carried out according to a new classifier):

| Old codes | New codes |

| 52.48.22 — Retail trade in jewelry | 47.77.2 - Retail trade in jewelry in specialized stores |

| 51.52.23 — Wholesale trade in gold and other precious metals (purchase) | 46.72.23 — Wholesale trade in gold and other precious metals (purchase) |

| 51.56.3 — Wholesale trade in precious stones (purchase) | 46.76.4 – Wholesale trade in precious stones (purchase) |

| 36.22.5 — Production of jewelry (placement of orders for production from own materials) | 32.12.5 - Production of jewelry, medals from precious metals and precious stones (placement of orders for production from own materials) |

Explanation for the tax inspectorate: the main type of activity is retail trade, including products manufactured at third-party production according to your order from your materials, which you bought from the population as raw materials for production.

The type of activity “retail trade” automatically involves the purchase of wholesale quantities of jewelry for the purpose of subsequent retail sale. Naturally, such an acquisition is not a separate type of activity.

The type of activity “jewelry manufacturing” automatically involves the purchase of raw materials and the sale of finished products.

The purchase of jewelry and scrap jewelry implies two economic activity codes: wholesale trade in gold and wholesale trade in precious stones. This explanation was given at one time by the Assay Office.

Many people do not understand why buying one product is a wholesale purchase and not a retail purchase and sale. It is a common misconception that wholesale differs from retail in the number of products sold.

In accordance with Art. 492 of the Civil Code of the Russian Federation, under a retail purchase and sale agreement, a seller engaged in business activities of selling goods at retail undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to business activities.

Those. The main difference between wholesale and retail is not the quantity, but the purpose of the purchased products: for further business activities - wholesale, for personal consumption - retail.

Buying is not retail, even if you only bought one product. The purpose of the purchase is to use the purchased assets for subsequent profit. Those. this is wholesale. Jewelry is made of precious metals and precious stones, which means that buying is a wholesale purchase of both precious metals and precious stones.

The purchase rules were approved by Decree of the Government of the Russian Federation dated 06/07/2001 No. 444.

Excerpts from the Purchase Rules:

3. The buyer must have the necessary premises, equipment, inventory and a security system for the premises, ensure, in accordance with established requirements, registration, accounting, storage of purchased valuables and the necessary conditions for servicing the deliverers, as well as comply with the mandatory requirements of state standards, environmental, sanitary and epidemiological, hygienic, fire safety and other rules and regulations.

4. To carry out operations for receiving and testing valuables, the buyer must have:

a) weighing and other relevant equipment, as well as the necessary tools;

b) reagents necessary to determine the name and sample of precious metals in products and scrap.

5. The buying organization must have experts with appropriate qualifications in matters of examination and assessment of values. An individual entrepreneur - buyer must have the necessary qualifications in matters of examination and assessment of values.

The reagents according to your order will be made at your territorial Assay Supervision Inspectorate (they may ask you to submit your gold as a raw material for the reagents). And for experts there are special courses (for merchandising specialists in purchasing and pawnshops).

In accordance with clause 13 of the Purchase Rules, the buyer fills out a receipt indicating:

a) the name of the organization or the surname and initials of the individual entrepreneur - buyer;

b) the surname and initials of the deliverer, indicating the details of the document proving his identity;

c) the name of the product, parts of the product and their quantity, description of the imprint of the name mark (for pre-revolutionary products - the imprint of the master’s name) and the hallmark (for imported products - the imprint of the import mark);

d) name of precious metals, fineness, weight, contract price per gram and cost;

e) name of precious stones, their quantity and weight, contract price per carat, cost;

f) total weight of the product;

g) the amount to be paid to the deliverer of valuables.

From the point of view of financial monitoring, the information about the donor provided in the receipt is not enough to identify him. When purchasing, the operation “purchase, purchase and sale of precious metals, precious stones, jewelry and scrap of such products” is carried out, subject to Law 115-FZ. You must identify your client. Because This is not a retail sale of jewelry, there is no identification limit, i.e. must be identified in any case.

In order for the purchase receipt to also act as a questionnaire (in order not to make an additional questionnaire), you need to include in the receipt the information necessary for identification in accordance with Law 115-FZ:

- last name, first name, and patronymic (unless otherwise follows from the law or national custom);

— citizenship;

- Date of Birth;

— details of an identity document (passport, foreign passport, military ID, passport of a foreign citizen, etc.): name, series and number of the document, date of issue of the document, name of the authority that issued the document, and department code (if any);

— details of a migration card, a document confirming the right of a foreign citizen or stateless person to stay (reside) in the Russian Federation;

— information about whether the individual is a foreign public official;

— address of place of residence (registration) or place of stay;

— taxpayer identification number (if available);

— contact information (for example, telephone number, fax number, email address, etc.).

When you include the listed identification information about the client in the purchase receipt, you can write in the internal control rules that the purchase receipt acts as a questionnaire.

In practice, the work of filling out such a receipt becomes slightly more complicated; the receiver must take a little more information from the client’s passport. You can also provide a column in the receipt for the client to sign that he is not a foreign public person.

Placing orders to make jewelry from your own materials requires a manufacturing code with appropriate explanation. This type of activity involves the acquisition of raw materials (precious metals and precious stones), placing an order under a contract, and selling finished products. If raw materials were purchased somewhere on the side (legally, of course), for example, bars in a jar, granules from wholesalers, then there would be no need to organize your own purchase. But since raw materials are purchased from the population, purchase codes are needed. Naturally, if there is a purchase, you can also buy bank metal.

At the same time, due to changes in the legislation on precious metals (41-FZ), purchased scrap must undergo refining before being put into production. The store can do this by sending it to the processor on a toll basis; processors concentrate similar scrap from many distributors and send it to a refinery; Then the refined metal is sent to a jewelry factory. A jewelry factory can do this by centrally sending metal from different customers for refining. It is better to stipulate such distribution of responsibilities in the contract.

The store may use its own unsold or defective products as customer-provided raw materials. The store can write off these items as surplus or scrap and use them to place an order at a jewelry factory. If these products were not manufactured by the same jewelry factory where the new order is placed, then they must also undergo refining.

You can also sell finished products in different ways: through your own store - this is pure retail, or sell to others, then the store will also need an OKVED code for wholesale trade.

Regarding taxation: when making a purchase, placing orders for the production of jewelry from purchased raw materials, or retailing manufactured jewelry through its store, this store remains on UTII. Read the letters from the Ministry of Finance about UTII for purchasing and retail (https://dmetconsult.ru/dokumenty, section “Purchase”): entrepreneurial activity related to retail sales through a chain of stores of jewelry manufactured by third parties (jewelry factories and individual entrepreneurs) from customer-supplied raw materials of the seller, subject to the above legislation, can be recognized as retail trade and transferred to the payment of a single tax on imputed income.

Let me explain once again: toll-and-pay production scheme and retail trade - UTII, toll-toll production scheme and wholesale trade (wholesale sale of purchased valuables or manufactured jewelry) - simplified tax system.

In passing, I would like to note that there is no need to submit any lists of purchase clients to the tax office.

Activities for a retail store (purchasing, placing orders) will also require the formation of statistical reporting in the 2-DM form. The form was approved by Rosstat Resolution No. 88 on November 14, 2007. The resolution can be downloaded: https://dmetconsult.ru/dokumenty (Goskomstat section).

The purchase of valuables (in terms of purity) is reflected in the statistical report as a receipt; As an expense, you reflect both the losses of the refinery and the contractor's expenses for the manufacture of jewelry (finished products and losses) based on his reports. Residues include the scrap you bought yourself, the remnants of your metal from the recycler (at a refinery), and the remnants of your metal at the jewelry factory.

The movement of finished jewelry in trade is not reflected in statistical reporting.

Thus, in order to legally carry out transactions with precious metals and precious stones and move these values along the entire chain: an individual - a purchasing point - a refinery - a jewelry factory - a retail store - an individual, all of the above is necessary. You can organize work at the point of sale to exchange old products for new ones (with or without additional payment), taking into account compliance with the described nuances of the law.

Source: EXPO-JEWELER magazine No. 3'102 (October - November 2016)

Gallery

Real state of affairs

Pawnshops have found a completely legal way to circumvent the direct ban. Many people practice accepting gold jewelry and their scrap, giving the client money in their hands immediately. How it works? An agreement is concluded for 1 day, and the client writes a waiver of the month-long period of time allotted to him by law. Formally, he hands over the item to a pawnshop for a short period of time and receives a loan. And after just 1 day the company can dispose of his property at its own discretion.

Many pawnshops ask clients to notify them in advance if they intend to buy back the items offered as collateral. If they announce their intention to simply sell products made of precious metals, then the price can be significantly increased. This is due to the fact that the pawnshop does not need to spend money on organizing the storage of the item, insuring it for a long time, etc. Costs are lower, the item can be sold faster, so the prices are more attractive.

Although it is important to understand that the pawnshop’s offer and the official gold-to-currency exchange rate may differ slightly. Still, handing over bullion and jewelry (as well as their scrap) are somewhat different operations.

One of the points is that products are purchased as scrap, by weight. And if the item has some stones, this is often not taken into account and is not reflected in the price. If such decorative elements are large, then it makes sense to look for a specialized purchase. Another nuance is that it is rational to take only standard items to the pawnshop. Family jewels and similar things are not always highly valued there. Therefore, this point must be clarified in advance at the chosen pawnshop.

Rules for purchasing precious metals and stones

Based on Decree of the Government of the Russian Federation of June 7, 2001 N 444 (as amended on May 8, 2002)

1. Regardless of the form of ownership, the Buyer must have a license to purchase jewelry or scrap valuable metals, and also provide it upon the first request of clients or government officials.

2. The assessment and acquisition of valuables must take place in an equipped room with a security system and taking into account other requirements of state standards.

3. The assessment of items must be carried out by a qualified expert appraiser, who is obliged to provide the owner of the product with reliable information about the actual cost of the item in question.

4. The following items are prohibited from purchasing:

- Noble metals in the form of nuggets, sand, ingots, industrial materials (foil, plates, wire, contacts, tape and others), industrial products, dental semi-finished products, except discs and crowns;

- Limited circulation items such as antique firearms or bladed weapons trimmed with precious metals or stones.

- Semi-finished products and precious stones in natural form: diamonds, natural pearls, emeralds, alexandrites, sapphires, rubies and others.

5. Acceptance of personalized commemorative or anniversary medals is possible only if the client provides the appropriate documentation for the right to own such medals.

6. Any type of assessment or examination must be carried out in the presence of the owner of the product, and must also exclude any damage to the product.

7. The weight of precious stones, as well as platinum, gold and palladium, is determined to hundredths of a gram, with the exception of cases where the weight of stones is determined by instruments without removing them from jewelry. In this case, the weight of precious stones is determined to tenths, just like the weight of silver. The buyer is legally responsible for the correct assessment of the items accepted. When purchasing jewelry and other household products and scrap of such products, their net weight is taken into account as 97 parts of their ligature weight. This is due to the average irreversible losses that occur during metal processing, including the presence of dirt (grease) in products, steel springs in locks, residues of inserts (sprinkling, enamel), as well as an underestimated content of the main precious metal in the alloy of the declared grade for some products.

8. All payments when purchasing gold and valuables are made by agreement.

9. Upon reaching an agreement on the cost of the product, the Buyer provides a receipt for payment of money in two copies. After payment, the client remains with one copy of the o.

10. The receipt must reflect the following information:

- Full details of the Buyer;

- Client's full name and passport details;

- Name of the precious metal (by sample), brief description * price per gram and total cost of the entire metal

- Total weight of precious metal

- Total cost of all metal purchased

11. After payment, products accepted for purchase cannot be returned.

Note* For precious stones, the size, their quantity and weight, the agreed price per carat, and the total cost must be indicated. For medium (from 0.30 to 0.99 carats) and large (from one carat) stones, the clarity of the stone, color group and cut type (round, oval, square, ball, pear, princess, emerald, and so on) are additionally indicated.

A law on licensing the purchase and processing of precious metals has been adopted

►

forecasts and analytics

►

golden educational program

►

watch video

According to the adopted changes, two types of licenses have been introduced. The first of them will allow the purchase of gold and other metals from citizens in the form of jewelry made from precious stones and precious metals, including scrap.

The second will allow recycling and processing activities involving waste and scrap precious metals. As an exception, the processing and processing of jewelry and other products made from precious metals of their own making, returned to the manufacturer or unsold, as well as scrap and waste from such products, carried out by enterprises and individuals is not licensed.

This law is officially published and comes into force 10 days after its publication. A transition period has been established during which persons and organizations engaged in these activities must obtain appropriate licenses. This must be done no later than one and a half years from the date of entry into force of the law.

The initiator of this change in legislation was the government of the Russian Federation. Thus, the country's leadership is trying to reduce the number of abuses in the processing of precious metals and increase the efficiency of supervision and control activities.

According to Alexei Moiseev, Deputy Minister of Finance of Russia, currently the activities of pawnshops, in contrast to purchases, are supervised by the structures of the Bank of Russia. To get out of control, now it is enough to rename the “pawnshop” to “buying up” and do everything the same, but uncontrollably. This state of affairs entails numerous abuses. Law enforcement agencies, Rosfinmonitoring and the Ministry of Finance of the Russian Federation have information about growing volumes of unknown, illegal precious metal entering circulation, presumably of origin associated with secondary processing and processing.

Current information confirms that such “processing” enterprises are often registered in ordinary residential apartments. Since no one is engaged in any processing or processing there, this is a real underground production that must be stopped.

It is worth noting that every year, under the guise of imaginary waste and scrap, about 50 tons of unaccounted for gold are taken from nowhere. No one has a clear idea about the origin of this precious metal. According to the leadership of the Ministry of Finance of the Russian Federation, such yellow metal can be illegally extracted from used electronic devices, illegally imported from abroad, or simply stolen from mining or refining enterprises.

Legislative framework of the Russian Federation

valid Editorial from 14.11.1972

detailed information

| Name of document | “RULES OF OPERATION OF POINTS FOR PURCHASE OF PRECIOUS METALS, STONES AND PRODUCTS FROM THEM FROM THE POPULATION” (together with “INSTRUCTIONS ON THE PROCEDURE FOR executing OPERATIONS FOR PURCHASE OF VALUABLES AND ON THE ORGANIZATION OF ACCOUNTING AND REPORTING IN PURCHASE POINTS PRECIOUS METALS, STONES AND PRODUCTS FROM THEM IN THE POPULATION ") (approved by Order of the USSR Ministry of Trade dated November 14, 1972 N 212) |

| Document type | instructions, rules |

| Receiving authority | USSR Ministry of Trade |

| Document Number | 212 |

| Acceptance date | 01.01.1970 |

| Revision date | 14.11.1972 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

“RULES OF OPERATION OF POINTS FOR PURCHASE OF PRECIOUS METALS, STONES AND PRODUCTS FROM THEM FROM THE POPULATION” (together with “INSTRUCTIONS ON THE PROCEDURE FOR executing OPERATIONS FOR PURCHASE OF VALUABLES AND ON THE ORGANIZATION OF ACCOUNTING AND REPORTING IN PURCHASE POINTS PRECIOUS METALS, STONES AND PRODUCTS FROM THEM IN THE POPULATION ") (approved by Order of the USSR Ministry of Trade dated November 14, 1972 N 212)

Instructions

I. CLEARANCE OF COMMODITY AND MONEY OPERATIONS

1. Registration of commodity transactions at all points is carried out according to the forms of accounting documents attached to these Instructions.

Registration of monetary transactions is carried out in the manner and in the forms provided for by the Regulations on the conduct of cash transactions by enterprises, institutions and organizations, approved by Resolution of the Council of Ministers of the USSR of August 6, 1973 N 552, put into effect by order of the Ministry of Trade of the USSR of August 22, 1973 N 162, and these Instructions.

2. All purchased valuables come under the financial responsibility of the head of the purchasing point or the merchandiser-buyer and must be immediately capitalized.

3. The purchase of valuables is formalized by receipts (Form No. 1), which are strict reporting forms, issued in the prescribed manner, numbered in a typographical manner, and stored in the cash desk of offices or auctions. Each set of receipts with one number in four copies is estimated at 10 kopecks. and is taken into account on the balance sheet.

4. Receipts (Form No. 1) are issued to the head of the point of purchase from the office or trading desk against a receipt on the expense stock order in a numbered and laced form, with a control stamp of the office or trading on each form. On the back of the last sheet of the receipt book, the starting and ending numbers of the receipts and the total number of sheets in the book are indicated.

This data is certified by the signatures of the director and chief accountant of the office or trade.

In those purchasing points where the purchase of valuables is carried out by several commodity experts-buyers, the head of the purchasing point issues receipt books to the commodity experts-buyers according to the statement against receipt. The manager reports on the receipt books used to the accounting department of the office or trade, if the purchase item is independent.

If the purchasing point is located at the store, receipts (Form No. 1) are issued to the store director, who issues them against signature to the merchandiser-buyer. The merchandising buyer reports on used receipt books to the store's accounting department.

5. Payment for purchased valuables from the population is made in cash from the cash desk of the purchase point.

When the purchasing point is located at the store, payment is made with the permission of the relevant branch of the State Bank by the store’s cash desk from current proceeds.

It is prohibited for a commodity buyer who purchases valuables from the population to make settlements with the seller and valuables himself.

6. Providing cash purchase points for payment for valuables purchased from the population is carried out by the cash office of the office or trading (if the buying point is at the store) on the basis of written orders of the office, trading in agreement with the relevant branch of the State Bank.

7. Cash issuance from the cash desk of an office, trade or store is carried out directly by the head of the purchase point or, by his one-time power of attorney, to the cashier of the purchase point in the amount of the approved daily limit, minus the balance of the unspent amount at the beginning of the operating day.

8. Receipts (Form No. 1) for purchased valuables are issued in four copies.

9. Entries in receipts are made as a carbon copy using a chemical pencil or ballpoint pen, clearly and clearly, without blots or erasures. Corrections to issued receipts are not permitted.

If an error occurs during checkout, all four copies of the receipt are cancelled, and a note is made in them signed by the merchandiser-buyer and the cashier, indicating which number replaced the damaged receipt, if a replacement took place.

Three copies of the canceled receipt are attached to the report of the purchase point, the fourth - the counterfoil remains in the files of the purchase point.

The receipt accurately indicates the details of the purchased value, i.e. its full and correct name, description and distinctive features necessary to determine its value according to the current purchase price list. (Clause 9 of the Instructions is as amended by Order of the USSR Ministry of Trade dated October 27, 1983 N 247.

10. Receipts of purchased valuables contain a description in strict accordance with the nomenclature indicated below:

a) jewelry consisting of several types of valuables (items with precious stones, gold watches with precious stones) - a detailed calculation is provided according to which money is paid to the seller of the valuables, and also indicates:

product name;

name of precious metals, fineness, weight, purchase price per gram and amount;

name of precious stones, code according to the price list of purchase prices, quantity, weight, purchase price per carat, amount;

the total weight of the product, indicating the total amount to be paid to the seller of valuables, according to the calculation given in the receipt;

b) watches - the receipt indicates the name of the watch, brand (company), number of the mechanism or case, category of restoration of the mechanism, indicating the amount to be paid to the seller of the watch;

c) platinum, gold and silver watches - in addition to the above description of the watch, the receipt indicates the fineness, weight of the case, purchase price per gram of metal and the amount of the cost of the case;

d) gold, platinum and silver products, gold, platinum, palladium and silver of complex restoration and scrap - the names of products or parts of products are recorded, indicating their quantity, type of metal and its sample, weight, purchase price per gram and amount;

e) products made of gold and platinum with semi-precious and ornamental stones that require restoration - each product is recorded individually, indicating the sample, weight, purchase price per gram and amount;

f) piece items made of silver, including knives, forks, etc. with silver cuttings - recorded by name, indicating the sample, quantity, purchase price per piece and amount;

g) crystal in silver and gold frames - each item is recorded individually, indicating the article number and price according to the price list for crystal, the name of the metal of the frame, the standard and weight of the frame, the price per gram and per frame, the total weight of the item and its purchase price;

h) handmade cameos from shells, semi-precious and ornamental stones and frames made of precious metals - each cameo is recorded individually, indicating the serial number according to the purchase price list, the weight of precious metals, the price per gram of precious metals and the purchase price of the cameo by grade;

i) cameos without frames, handmade, from shells, semi-precious and ornamental stones - are recorded by name, grade, indicating the serial number according to the purchase price list, quantity and purchase price per piece;

j) large diamonds (from 1 carat and above), medium (from 0.50 to 0.99 carats) - each stone is recorded individually, indicating its name, purchase price list code, weight, purchase price per carat and amount;

k) rose cut diamonds and simplified cut diamonds up to 0.49 carats - recorded by name, code according to the purchase price list, quantity, weight, purchase price per carat and amount;

m) emeralds, sapphires and rubies:

weighing up to 1 carat - recorded by name, code according to the price list of purchase prices, quantity, weight, purchase price per carat and amount;

weighing from 1 carat and above - each stone is recorded individually, indicating the name, code according to the purchase price list, purchase price per carat and amount;

m) pearls:

oriental and river - recorded according to the description provided in the price list of purchase prices, the number of grains, weight, purchase price per carat and amount;

natural Kafim - recorded according to the description provided in the price list of purchase prices, weight, purchase price per gram and amount;

o) semi-precious and ornamental stones - recorded by name, indicating the code for the price list of purchase prices, weight, purchase price per gram and amount.

12. The first three copies of the receipt are handed over to the seller of valuables, who presents them to the cashier. The cashier is obliged to check the authenticity of the receipt, the absence of corrections, the correctness of the taxation and, after the seller of valuables has signed the receipt of money on all three copies of the receipt, give the seller of valuables the amount due to him along with the third copy of the receipt, with the stamp “paid”.

The first copy of the receipt is sent to the purchase point during the report, the second is sent along with the valuables, the fourth copy remains in the files of the purchase point, where it is stored as a supporting document.

13. After issuing money to the seller of valuables, the cashier immediately records the paid amount in the daily list of purchases of valuables (Form No. 2) in the appropriate group indicating the receipt number.

14. At the end of the working day, the cashier calculates the daily list of purchases of valuables, determines the amount and number of receipts paid by him for the current day, checks the counting data with the registers compiled by the head of the purchase point or the merchandise buyer, and signs the statement together with him. The results of the amounts paid per day are recorded by the cashier in the summary purchase statement (Form No. 3). In addition, the cashier is required to maintain a daily cash book (Form N K-6), the second copy of which is a cash report.

It is not allowed to combine in one cash report entries on the receipt and expenditure of cash amounts for several days.

15. The cashier of the purchasing point submits daily to the accounting department of the office, trade or store:

a) daily statements of purchases of valuables (Form No. 2) with receipts attached to them (Form No. 1);

b) daily cash reports (2nd copy of the cash book in Form N K-6).

16. The head of the purchasing point (directly purchasing valuables) or the merchandiser-buyer, after paying for the valuables according to the receipt issued by him, immediately records the purchased valuables in the register (Form No. 4).

Registers are maintained separately:

a) for jewelry (products with precious stones) - (Form No. 4-c);

b) for precious and semi-precious stones - (Form No. 4-a);

c) for gold and platinum products of complex restoration and scrap - gold, platinum and palladium (form N 4-a);

d) for silver products, complex restoration products and scrap - silver (form N 4-a);

e) for crystal and porcelain in a silver frame (form N 4-a);

f) for hours (form N 4-b).

Registers for each type of valuables are compiled in triplicate, and in points where there are receivers - in four.

Registers are registered in a book (form N 5), where each register is assigned a serial number. After sending the valuables included in this register, the number of the act of investment and the number of the parcel in which the valuables were sent are noted in the book (Form No. 5).

In those buying points where, in addition to the manager, the purchase of valuables is also carried out by the merchandiser-buyer, the latter, at the end of the working day, transfers according to the register all the valuables accepted for the day to the head of the buying point against receipt on all four copies of the register. One copy of the register remains with the merchant-buyer as a supporting document for the delivery of purchased valuables.

17. At the end of the working day, the head of the purchasing point:

a) calculates the weight of purchased valuables and the amount paid for each register;

b) checks the sum of the totals of all registers for a given day with the total of the daily statement of purchases of valuables (Form No. 2) and, after reconciliation, signs it together with the cashier;

c) makes in each register for gold, platinum and silver products and for gold, platinum, palladium and silver of complex restoration and scrap a selective entry of weight values in the context of samples and prices, indicating the weight, the amount for each sample and price with the input of the total weight and sums of values.

NOTE. If there is a small influx of valuables during the day, it is allowed to keep records in one register for several days (one month), but with the obligatory display of results separately for each day and the total for the entire register.

18. Parcels with purchased valuables are sent to the Central Purchasing Base at least once a month in agreement with the base.

19. Sending of valuables to the Central purchasing database is carried out completely for each register. Sending purchased valuables recorded in one register in different parcels or leaving them partially at purchase points is prohibited.

20. An act of investment (Form No. 6) is drawn up in triplicate for the valuables invested in the parcel; the act is signed by the head of the purchasing point, the cashier, and the accountant. If the purchasing point is located at the store, then the store director, merchandising buyer, accountant, and cashier will be present and sign the act during the investment.

21. One copy of the enclosure act and one copy of the register are included in the sent parcel. The next parcel number is placed on the parcel and the enclosure document. Sent parcels are registered in the parcel registration book (Form No. 7). The second copy of the investment act is attached to the report (Form No. 9), the third remains in the files of the purchase point.

22. An invoice is issued in five copies for the valuables sent at the point of purchase. The first three copies are sent to the office or market for presentation for collection, the fourth is attached to the report (Form No. 9), the fifth - the counterfoil remains in the files of the purchase point.

II. REGISTRATION OF OPERATIONS ACCORDING TO VALUES ACCEPTED WITH SUBSEQUENT ASSESSMENT

23. Accepted for subsequent assessment of value, in accordance with clause 15 of the Rules for the operation of purchasing points, are drawn up in acts (Form No. 8).

Acts (Form N , just like receipts, are strictly reporting forms, issued in the prescribed manner, stored in the cash office of an office or trade. Each set of acts with one number in five copies is estimated conditionally at 10 kopecks and is taken into account on the balance sheet. The procedure for issuing and reporting on acts (form N

, just like receipts, are strictly reporting forms, issued in the prescribed manner, stored in the cash office of an office or trade. Each set of acts with one number in five copies is estimated conditionally at 10 kopecks and is taken into account on the balance sheet. The procedure for issuing and reporting on acts (form N is the same as on receipt books (see paragraph 4 of these Instructions).

is the same as on receipt books (see paragraph 4 of these Instructions).

24. The act (form N for accepted values for subsequent evaluation is drawn up in five copies. The first copy of the act together with the report (form N 9) is sent to the store, office or trade, the second is sent to the accounting department of the Central purchasing database, the third is issued to the seller of the valuables , the fourth - together with the valuables is included in the parcel sent to the Central purchasing base, the fifth - the spine - remains in the files of the purchasing point.

for accepted values for subsequent evaluation is drawn up in five copies. The first copy of the act together with the report (form N 9) is sent to the store, office or trade, the second is sent to the accounting department of the Central purchasing database, the third is issued to the seller of the valuables , the fourth - together with the valuables is included in the parcel sent to the Central purchasing base, the fifth - the spine - remains in the files of the purchasing point.

25. In the report (Form No. 9), the values accepted by the purchase point for subsequent evaluation are shown upon receipt in a separate column on line 3 and when sent to the base on line 10. The text of the report makes reference to the register number and the number of the act attached to the report.

26. In cases where the seller of valuables does not agree with the assessment of the Central purchasing base, the latter, having received a notice from the purchasing point, immediately returns to the purchasing point the values accepted for assessment, according to the invoice base (of the usual form) with reference to the act number, according to to which the returned values were received by the base.

The manager or merchandiser-buyer of the purchasing point, having received the returned valuables from the accompanying invoice of the base, receives them according to his report (form No. 9) on line 5 and hands them to the owner against the latter’s signature on the act returned to him. A copy of the act with the owner’s receipt of receipt of the valuables serves as the basis for writing off the returned valuables according to the report on line 11 and is attached to the report (Form No. 9).

27. If the seller of valuables agrees with the assessment made by the Central Purchasing Base, the valuables are not returned to the purchasing point. In this case, the seller of valuables returns the act (form N) to the purchase point with a receipt indicating his agreement with the assessment made by the Central Purchase Base.

In this case, the seller of valuables returns the act (form N) to the purchase point with a receipt indicating his agreement with the assessment made by the Central Purchase Base.

The head of the purchasing point or the merchandising buyer formalizes in the usual manner, using a receipt (Form No. 1), the payment of money to the seller for the accepted values in the valuation amount determined by the Central Purchasing Base. The receipt contains a reference to the number of the act on which the calculation is made.

The act (Form N) indicates the number of the receipt on which the settlement with the seller of valuables was made. A second copy of the receipt is attached to the report (Form N 9) and is sent when reporting to the office or trade. Payment under the specified receipt is reflected in the report on line 4.

indicates the number of the receipt on which the settlement with the seller of valuables was made. A second copy of the receipt is attached to the report (Form N 9) and is sent when reporting to the office or trade. Payment under the specified receipt is reflected in the report on line 4.

Advertisement _

_

III. REPORTING OF FINANCIALLY RESPONSIBLE PERSONS

29. The head of the purchasing point, twice a month on the 16th and 1st, draws up a report (form No. 9) on the movement of purchased assets in two copies, one of which is sent to the accounting department of the office, trade or store where records of these transactions are kept .

The following must be attached to the report:

a) one copy of all registers for valuables purchased during the reporting period (Form No. 4-a, 4-b, 4-c);

b) acts of attachment for parcels sent during the reporting period (Form No. 6);

c) receipts from communications authorities for parcels sent;

d) acts (form N 8);

e) copies of invoices for sent valuables.

30. The inventory of valuables at purchase points is carried out in accordance with the Instructions on the procedure for conducting an inventory of valuables, funds and payments in organizations and enterprises of the USSR Ministry of Trade system, approved by order of the USSR Ministry of Trade of June 13, 1972 N 115.

IY. ACCOUNTING OF ACQUISITION OPERATIONS

31. Operations of purchase points are taken into account:

a) subordinate directly to offices or trading - centrally on the balance sheet of the office or trading;

b) located in stores that are on an independent balance sheet - on the store’s balance sheet.

Accounting is carried out according to the standard accounting plan for the main activities of organizations of the USSR Ministry of Trade.

32. When accepting reports from financially responsible persons, the accounting department is obliged to check on the day the report is received or no later than the next day the correctness of the reports and the documents attached to them. In particular, the following is checked:

a) correspondence of the amount of each receipt to the amount indicated in the daily list of purchases of valuables;

b) the correctness of the calculation of the results of the daily list of purchases of valuables;

c) compliance of the amount spent on the purchase of valuables with the indicators of cash reports;

d) the identity of the entries in the registers with the entries in the receipts and the final data of each register with the act of investment;

e) the correctness of the transfer into the report (Form No. 9) of the balances from the previous report and the final balance;

f) timely recording and inclusion in the report by the head of the purchase point of all purchased valuables for a given day and reporting period.

The accounting department corrects errors in taxation, calculations and document entries discovered during the check of the report by crossing out the incorrect amounts and writing the correct ones on top. The accounting department immediately informs financially responsible persons about corrections made in reports and receives from them written confirmation of the corrections made.

33. Valuables purchased from the population are accounted for by the accounting department at purchase prices in account No. 41-1 “Goods at bases and warehouses” in a separate analytical account “Values purchased from the population.”

Valuables accepted for subsequent evaluation are accounted for in off-balance sheet account N 004 “Inventory assets accepted for safekeeping.”

34. Analytical accounting of valuables is carried out by materially responsible persons in quantitative and total terms by type of metal, their weight, samples, weight and pieces of precious stones for each reporting period in accordance with the Instructions on the procedure for acceptance, storage, sale and accounting of precious stones metals and precious stones at trade enterprises of the USSR Ministry of Trade system, approved by order of the USSR Ministry of Trade of December 15, 1971 N 198.

35. Due to the fact that the dispatch of purchased valuables is carried out entirely according to each separate register, analytical accounting of valuables is also carried out according to registers, and write-off of disposed valuables is carried out according to each register (in a linear manner).

36. Expenses for the maintenance of purchase points are taken into account according to the established nomenclature of items on account No. 44 “Distribution costs”, analytical account “Costs for the maintenance of purchase points”.

Jewelry license

Obtaining a jewelry license or, in other words, registration with the state Assay Supervision Inspectorate is mandatory in cases where the following activities are planned:

- retail or wholesale trade in jewelry;

- cutting of precious stones;

- processing of waste and scrap precious metals;

- production, repair, purchase or transportation of jewelry, precious stones or metals.

Thus, all companies and individual entrepreneurs related to jewelry need to register: pawnshops, stores, manufacturers, wholesale suppliers, jewelry workshops, etc.

The Assay Supervision Inspectorate for the Moscow Region is located in Moscow and oversees the areas of activity described above not only in the capital, but also in eight nearby regions. You should contact this body not only to register with a special person, but also for territorial assignment, as well as on issues related to branding and testing.

will be happy to help you in obtaining a jewelry license and solving all related problems! We will not only help you create a package of documents, but we will also submit them to the inspectorate on the basis of a notarized power of attorney, we will advise you at all stages and promote your case during its consideration by the inspectorate until its successful completion - the issuance of a certificate.

What documents will we need?

- A copy of OGRN/TIN certificates of a legal entity or individual entrepreneur;

- Information about the address that will be used to conduct business;

- A copy of the IP/LLC passport.

Review deadlines and license validity period:

A legal entity (or individual entrepreneur) carrying out the types of activities specified above is obliged, within 30 calendar days from the date of registration or adding a new type of activity to the constituent documents, to register with the state Assay Supervision Inspectorate.

After submitting the package of necessary documents, the review lasts no more than 15 calendar days! After this period and within 3 days from the date of the decision, the applicant must receive a certificate of assignment of an account number or a notice of refusal with justification of the reasons.

If approved, the applicant receives not only a certificate, but also a special registration card certified by the inspection. By the way, the certificate is issued for a period of 5 years. Then you will need to get a new license, that is, get a special license. accounting again.

Why can they refuse to issue a license?

The Assay Supervision Inspectorate has the right to refuse registration in the following cases:

- Submission of an incomplete set of documents;

- Submission of documents that are executed incorrectly or contain unreliable or deliberately false information.

- Inaccuracy of information from legal entities regarding (legal address, director, participants)

- Lack of business premises

By the way, you can try to appeal the refusal and demand an independent examination and review. However, all this will take time. If you don’t want to risk money and waste time on proceedings, he will do everything right the first time!

What else does the inspectorate pay attention to when considering an application?

For this regulatory authority, it is important that the applicant has:

- an iron door in the room where jewelry will be stored;

- cash register (must meet the requirements that were approved from 01/01/2017);

By the way, as part of its duties, the inspectorate can conduct a compliance check, as well as request explanations from the licensee on issues that arose during the inspection, draw up reports on violations and set deadlines for their correction.

What is included in our service package?

Our company’s lawyers will not only help you prepare a package of documents, but also:

- provide advice on obtaining, renewing or re-issuing a license;

- check the premises for compliance with the requirements;

- provide support during formal and actual inspections;

- will provide all necessary accounting and legal assistance;

- will accompany you at all stages of the procedure until its logical conclusion - obtaining a certificate of registration for special training. accounting

- They will give you a set of documents received from the inspection.

In addition to assistance in registration, we can act as an intermediary in the process of registration or re-registration of a name tag - the manufacturer's imprint on a piece of jewelry. Registration of the name is carried out in the same body as registration.