Commission trading benefits both buyers and sellers. You can organize such a business in specialized stores or other retail outlets; there are no restrictions on this matter. In order for the activity to be carried out legally, the entrepreneur must declare the correct OKVED code “Commission trade” during state registration with the tax service.

Read also: Is it possible to carry out activities without OKVED

Commission trading concept

Commission trading means trading activities in which the relations of the parties are regulated by a commission agreement. At the same time, the seller sells goods transferred to him for sale by other persons. The participants in such relations are:

- principal (gives instructions to conclude purchase and sale transactions for a fee);

- commission agent (seller who carries out accepted orders for a certain percentage - commission).

New and used (used) non-food products, antiques, and art objects are accepted for commission. In addition, the commission can accept confiscated and ownerless property, as well as that which, by a court decision, became the property of the state.

Which OKVED code can you choose as an individual entrepreneur for retail trade in 2021?

- books;

- periodicals;

- video and audio recordings;

- sports equipment;

- toys;

- stationery;

- blank CDs and tapes;

- tourist equipment;

- fishing accessories;

- games;

- bicycles;

- boats.

OKVED specifically for retail trade is included in class 47. It is divided into groups, depending on the area of activity. The corresponding code (or several) must be indicated to the individual entrepreneur during registration with government agencies.

What will be the OKVED encoding “Commission trade” in 2019

The OKVED code “Commission trade” in 2021 must be taken from the current edition of the OKVED2 directory (approved by Rosstandart, order No. 14-st dated January 31, 2014, as amended on July 10, 2018). The official name of this classifier is “OK 029-2014 (NACE Rev. 2)”. The OKVED2 directory is very convenient to use, since similar types of activities are grouped in it into separate sections.

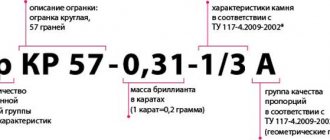

The OKVED code “Commission trade in non-food products” is selected as follows:

- We are looking for section “G” (wholesale and retail trade).

- We move to class “47” (wholesale trade, except motor vehicles).

- Next, we move to subclass “47.7” (trade in specialized stores of other goods).

To trade used goods, select the required code in the “47.79” group. This group includes activities related to retail trade:

- antiques (47.79.1);

- second-hand books (47.79.2);

- other used goods (47.79.3);

- activities of auction houses (47.79.4).

Group 47.79 does not include some types of commission trading. These are the following types of activities:

- sale of used cars (code 45.11);

- thrift store services (code 64.92);

- services of online auctions and other auctions (code 47.91, 47.99).

You can select several OKVED codes. But only one of them will be primary, and all other encodings will be additional. When registering with the Federal Tax Service, in a special application you must indicate the type of activity code, which will consist of at least 4 digital characters.

OKVED code 2

— production of products from the main components of an alloy of precious metals, such as: tableware, cutlery and utensils, toiletries, office and writing instruments, items for religious ceremonies, etc.;

— production of technical or laboratory products from alloys, including precious metals (except for tools and their parts): casting molds, spatulas, trays with a layer of metal applied by galvanic method, etc.;

We recommend reading: If you rent through an agency, is there a risk?

Commission trade in clothing

Trade in used clothing is in very high demand among the population. An item that is unnecessary for one person may be a necessary acquisition for another. Sometimes in such stores you can buy high-quality and rare (unique) things.

If you decide to open your own store for such trade, the following OKVED codes “Commission trade in clothing” will suit you:

- “47.79.3” – trade in other used goods;

- “47.71” – sale of clothing in specialized stores;

- "47.72" - sale of shoes.

OKVED table for retail trade in 2021

- Agriculture and forestry.

- Minerals.

- Processing production.

- Electrical energy, gas, steam.

- Water supply, environmental cleanup.

- Construction.

- Trade.

- Transportation and saving.

- Hotels and restaurants.

- Publishing, cinema, Internet communications, telecommunications.

- Finance.

- Real estate.

- Science and technology.

- Rent, insurance, employment.

- Military activities.

- Education.

- Medicine.

- Culture.

- Sport.

- Social organizations.

- Farms.

- Extraterritorial companies.

In 2021, the latest amendment to the OKVED code was made. Thanks to this, editions 1 and 1.1 will be canceled this year, and the appearance of the second edition is completely different from the previous ones, which introduces some difficulties in the preparation of documentation among entrepreneurs.

Commission trade in jewelry

Commission sale of jewelry is an alternative to pawnshop activity. Legal entities and individuals can engage in this type of activity.

The OKVED code “Commission trade in jewelry” can be selected from the following codes:

- “47.79.1” – trade in antiques;

- “47.79.3” – sale of other used goods;

- “47.99” – other trade outside shops and markets;

- “47.77” – sale of watches and jewelry (in specialized stores).

roznichnaya_torgovlya_-_okved_2021.jpg

In the group of activities related to the sale of food products, OKVED food trade is divided into two subgroups - 47.11 (sales are carried out in non-specialized retail outlets) and 47.2 (sales in specialized stores).

Related publications

Businesses based on the sale of different types of goods are assigned a section in the classifier, designated by the letter G. It contains codes for wholesalers and for retail participants. The activities of sellers in specialized and non-specialized retail outlets are examined separately.

Whether or not the selected type of activity is subject to licensing.

If the main type of activity is subject to mandatory licensing, then it is prohibited to carry out such activities without an appropriate license. See the list of licensed activities.

This group includes: - retail trade in radio and television equipment; — retail trade in audio and video equipment; — retail trade in CD, DVD players and recorders, etc.

When choosing your main activity, consider:

This group includes: - retail trade in music recordings, audio tapes, compact discs and cassettes; - retail sale of video cassettes and DVDs This class also includes: - retail sale of unrecorded tapes and discs

More to read —> Apartment building built on private land

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal trade enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. d. Retail trade is classified primarily by type of trading enterprise (retail trade in general assortment stores - groupings from 47.1 to 47.7, retail trade outside stores - groupings from 47.8 to 47.9). Retail trade in general merchandise stores includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above-mentioned groups are further subdivided according to the range of products sold. Sales of goods not through general stores are classified according to forms of trade, such as retail sales in stalls and markets (group 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (grouping 47.9). The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group

The Consulting website presents new OKVED codes that will help you when registering LLCs and individual entrepreneurs. To do this, just choose what your business will be and write down the code of this type of economic activity in the application for registration.

OKVED 2021 retail trade in jewelry and accessories

- retail sale of goods such as personal computers, stationery, paints or wood, although these products may not be suitable for personal or household purposes. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging

The first code indicated in the registration application is the code of the main type of activity. You need to choose it carefully to avoid unnecessary expenses. Based on the main OKVED, the tax office sets rates of insurance premiums for insuring employees against accidents and occupational diseases. The main activity is considered to be the one that generates the most income. It would be a shame if you indicate the production of vending machines with a tariff of 2.1 as your main activity and pay more fees when you receive all your income from printing activities with a tariff of 0.2.

More to read —> Sample application for inheritance of a minor

Some types of economic activity can only be carried out with a special permit or license. For example, installation of fire-fighting equipment or production and circulation of ethyl alcohol, alcoholic and alcohol-containing products. Therefore, choose the types of activities that you plan to engage in, and do not indicate unnecessary codes “in reserve.”

Gift for new LLCs

If you plan to retail sell motor vehicles and motorcycles, then choose OKVED in section 45. To choose the code correctly, you need to understand exactly what and how you will trade. Select the appropriate codes from the list:

Retail trade in general merchandise stores includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal trade enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. d.

Retail trade of costume jewelry OKVED 2021

The All-Russian Classifier of Types of Economic Activities (hereinafter referred to as OKVED) is nothing more than one of the documents from the set of documents of all-Russian classifiers of technical, economic and social information.

When opening an individual entrepreneur, you will need to indicate your passport details, address and OKVED codes in the application. The main code is indicated - there is one and up to 50 additional codes. You indicate these codes so that the tax office can determine what kind of activity you plan to engage in. She will determine this from the main OKVED code. The main OKVED code will affect:

Commission trade in cars

Many citizens of the Russian Federation refuse to buy used cars from private individuals in favor of proven and reliable organizations. The demand in this area is quite high, so the business of selling used cars can be very profitable. Before accepting a car for consignment trade, you should have it diagnosed at a service center.

The OKVED code “Commission trade in cars” is not included in the group “47.79”; it refers to a different type of activity. The code is selected as follows:

- In section “G” of the classifier we move to class “45”, then to subclass “45.1” “Trade in motor vehicles”.

- We are looking for the grouping “45.11”, this will be the required code for commission trade in motor vehicles.

The coding “45.11” is suitable for trading in both new and used cars and light-duty trucks. The sale of SUVs weighing no more than 3.5 tons also applies here.

As an additional code to OKVED “Commission trade in motor vehicles”, you can specify the code “47.99”.

Possible codes for commission trading are presented in our table.

Read also: Changing OKVED codes: step-by-step instructions

OKVED 2021 Retail Trade of Jewelry and Accessories

The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group

OKVED 2021 retail

We are sure that every novice entrepreneur knows what OKVED is. But just in case, we remind you that the All-Russian Classifier of Types of Economic Activities (OKVED) is a document designed to classify and code types of economic activities and information about them.

The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group.

Wholesale trade of building materials: OKVED in 2021

But there is also the possibility of difficulties arising when refunding VAT or when applying special tax regimes if the necessary codes are not in the Unified State Register of Legal Entities. True, such claims from tax authorities are easily disputed in the courts. But it’s still easier not to bring the situation to trial.

Firstly, an unlikely, but at the same time possible, situation may arise when tax authorities fine you for failure to notify about the new OKVED code. The fact is that clause 5 of the law “On State Registration...” dated 08.08.2021 No. 129-FZ obliges changes to be made to the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs within three days from the date of occurrence of the changes. In the case of OKVED, this is the beginning of a new type of activity.

How to sell souvenirs according to OKVED

In the case of wholesale supplies, lawyers still recommend using a more specific coding of your activities. But this should be done only if there is a purchase and sale agreement with non-standard conditions for the transfer of ownership of the goods.

As for the direct sale of souvenir products, it will be much easier for entrepreneurs who decide to make this activity their main activity. OKVED has a section and subclass that clearly defines the trade in souvenirs.

We recommend reading: Latest News Maternity Capital In 2020

OKVED codes for wholesale trade in 2021 and decoding

Code group 47.52 from OKVED-2 2021 is suitable for registering a business selling building materials at retail. This code has its own name: “Retail sales of paints and varnishes, hardware, glass products in specialized retail outlets.” In this category, for example, there is this: 47.52.7 “Retail sales of building materials that do not belong to other categories of goods in specialized retail outlets.” In addition, this group contains codes that allow the following products to be sold at retail:

The selected OKVED code can be changed if necessary. This is possible if there is no additional need to change the information written in the company’s Charter. , the entrepreneur must fill out the fields on the title page of the application, as well as additional sheets P and H. Form P14001 is taken as a basis. Sheet H (1st page) indicates the codes to be added. The codes to be deleted must be written down on the 2nd page of the same sheet.

Site search

Click on the “star” to add this code to your list. Ask a Question. Whether or not the selected type of activity is subject to licensing. If the main type of activity is subject to mandatory licensing, then it is prohibited to carry out such activities without an appropriate license. See the list of licensed activities. Organizational and legal form of a legal entity. Some types of activities do not fit certain organizational and legal forms.

OKVED code 52.48.22 - Retail trade in jewelry

Back Close. X Making various changes to the LLC. All Russia. Set of documents. Documents for self-submission Documents for LLC liquidation. X Registration of individual entrepreneurs. Documents for self-submission Documents for individual entrepreneur registration. Registration of individual entrepreneurs without registration in Moscow. Documents for self-submission Documents for liquidation of individual entrepreneurs.

Since income from different groups of goods or the end buyer (wholesale or retail) will have a different share in the total income of the company, the main OKVED will depend on this. The activity with the highest income will be set as the main one for the current year.

OKVED codes for online stores, relevant in 2021

- variety of goods;

- low prices compared to regular stores;

- the ability to select and compare products from different stores indefinitely;

- availability of reviews and online consultations;

- inability to try on and feel the chosen item before purchasing.

When applying for business registration, you must select codes from the All-Russian Classifier of Types of Economic Activities (OKVED). These are numbers that help the Federal Tax Service control the work of a legal entity or individual entrepreneur in accordance with the chosen type of business.

OKVED jewelry sale 2021

12 of Law No. 99-FZ, we have compiled this list: The licensed types of activities in 2021 do not always exactly correspond to OKVED codes, which must be indicated in the application for registration of individual entrepreneurs and LLCs. Some types of activities according to the OKVED classifier are almost completely repeated in the text of laws. But if we take as an example such a licensed area as pharmaceutical activity, then it will correspond to several OKVED codes at once. 2021, the following concept is given: “pharmaceutical activities - activities that include wholesale trade in medicines, their storage, transportation and/or retail trade in medicines, their dispensing, storage, transportation, manufacturing of medicines.” OKVED codes permitted for pharmaceutical activities will be as follows: Working without a license, if by law this activity must be licensed, is punishable by fines, confiscation of property, equipment and materials, and other sanctions.

These types of activities in the Russian Federation are regulated by separate laws: As you can see, these are mainly areas that require serious financial investments, so small businesses rarely choose such areas of activity, with the exception of the sale of alcohol. But the list of licensed types of activities specified in Law No. 99-FZ of 2017 includes many areas popular among novice businessmen, so we suggest that you familiarize yourself with it in more detail. Types of activities in Russia for which a license must be obtained in accordance with Art.

We recommend reading: When snils were introduced in Russia