Of all the precious metals, gold and silver have long served as excellent means of currency, as world currencies have been pegged to bimetallic standards for several centuries. The US currency's link to silver remained until the 1960s, while the US dollar's link to gold was ended in 1971 when President Nixon ended the dollar's fixed-rate convertibility into gold. This depegging of the gold price is often referred to as the “initial public offering of gold,” which democratized the precious metal as an asset and paved the way for its strategic investment role in the modern portfolio to help navigate changing business cycles.

From Currency to Asset Class: Understanding the Two Price Drivers of Precious Metals

Gold and silver have taken different paths since their humble beginnings as currencies, but both are now attractive to global investors as a potential store of value and source of portfolio diversification. However, there are some significant differences in terms of the unique role each asset can play in a portfolio in terms of price, performance, volatility and risk management.

As with most real assets, the price movements of both assets are determined by their unique sources of supply and demand. Today, silver remains a widely used precious metal, and its price is largely determined by industrial demand and mining. Over time, the demand for silver tends to rise and fall linearly with overall economic growth, largely due to its varied industrial uses.

In contrast, gold has a more diverse set of demand drivers, ranging from industrial and technological uses to a mature global jewelry market. Apart from its use among investors, gold also serves as a reserve asset for central banks around the world. This diversity in demand, both cyclical and countercyclical, has helped maintain gold's low correlation with traditional stocks, bonds and some real assets at various stages of the full economic cycle.

In fact, gold's unique demand dynamics make it suitable for managing a range of systemic risks and market challenges during various business cycles. In 2021, many noted its various benefits of gold as global investors flocked to gold for its safety and high liquidity, leading to a shift in demand. Rising investment in gold helped offset pandemic-related declines in jewelry demand and central bank purchases.

In terms of supply dynamics, gold's higher scarcity relative to silver is reflected in the historical price differential between the two precious metals. But looking at the difference shows how the unique characteristics of gold supply and demand have led to lower overall price volatility over time and across different business cycles. As shown in the first graph, in terms of tons, the annual supply of silver is about seven times the supply of gold. However, based on market values, the annual supply of silver is a small fraction of the supply of gold, which could result in reduced liquidity and higher volatility in the global silver market (see chart below).

What is heavier with the same volume - gold or silver?

Let's try to figure out this simple question. To answer this, we first need to remember what we were taught at school in physics and chemistry lessons. So, in order to find out the mass, you need to multiply the density by the volume. Accordingly, with equal volume we look at the density. Now we take specific values for each of the precious metals. In particular, density:

• silver – 10,500 kilograms per cubic meter; • gold – 19320.

That's all - the answer to the question has been found. Since the density of gold is higher, this precious metal is heavier. It is clear that we are talking about the same volumes of precious metals. Without this clarification, the comparison will simply be incorrect. It turns out that a ton of gold will take up approximately 2 times less space than a silver bar with the same weight. If you take two pieces of precious metal that are identical in size, then the gold one will be heavier. Let's give a simple example with specific numbers.

A ball with a diameter of 46.23 millimeters, made of gold, will weigh 1 kilogram. Therefore, even relatively light jewelry made from this precious metal looks impressive.

For companies involved in gold exploration and mining, deposits that contain at least one gram (.) of gold for every ton of land are extremely promising.

Returns on gold and silver

The gold to silver ratio is a technical pricing indicator that can be used to assess the relative value of each precious metal. As you can see in the chart below, a lower number reflects that gold is undervalued, while a higher number implies that silver is relatively more attractive. While the ratio often shows which precious metal may be overvalued currently, it also demonstrates the fact that silver's reliance on industrial applications to support demand makes it more vulnerable to declining real yields during certain business cycles, which in turn helps gold maintain high real returns over time.

Luxurious stones in a silver frame

Gold or silver – which is more useful if you are buying an everyday accessory. What is important here is a stone that harmonizes or disharmonizes with the metal of the frame. Silver ionizes the air, gold has antiseptic properties. Precious metals do not cause allergies.

The useful stones with which the frame is decorated affect the cost. Of course, if we compare jewelry with turquoise in a gold frame and an accessory with carnelian in silver, the cost is higher for gold. But when it comes to precious stones - ruby , emerald , sapphire , large diamond Silver with large, correctly cut stones without defects and pure colors is the most valued. The number of carats (weight) is also significant. Silver with precious stones of fancy colors (rare variations of shade within the same mineral) costs more than gold with other stones.

Analysis of the effectiveness of diversification of each asset

Understanding the diversification properties of each precious metal—or the strength and direction of the linear relationship between them—is another tool investors use to achieve an improved risk/return profile. Adding assets that have a low correlation to each other can also provide diversification, which helps investors seeking to optimize portfolio performance through cyclical and countercyclical market movements.

The table to the right shows that gold's lower correlation over the past year with both global equities and commodities overall highlights its potential to provide superior diversification performance on a relative basis relative to the broad movements of these asset classes.

Effective portfolio diversification can be measured by its risk-adjusted returns over time. The chart to the right shows that gold has historically delivered competitive returns and has outperformed silver on average over a number of past black swan events. Gold's ability to hedge significant equity declines, thereby reducing portfolio drawdowns, is a key example of one of the potential benefits of diversification.

Why compare one asset to another?

For most traders, it all comes down to accumulating fiat money. The US dollar, for example, is used as a benchmark for the performance of their portfolio, and they will move back and forth between dollars and other assets. The goal is to enter and exit trades at the right times to continually increase your account's dollar balance. And Forex brokers rarely offer pairs that are not related to the dollar for trading.

However, some traders are not interested in accumulating fiat currency. A certain portion of gold and cryptocurrency traders are primarily concerned with accumulating more gold and bitcoins, respectively. This could be because they have a negative view of fiat currencies in general or expect these hard assets to significantly outperform government bond yields over the long term. By trading in the precious metals markets and the broader crypto market for Bitcoin traders, they are trying to increase their holdings without having to convert them into fiat money. The reason this is important to all of us is that there may be a lot of useful information in those asset pairs that we rarely look at.

Understanding Value at Risk

Volatility is another metric that investors use to understand the level of risk associated with an investment. In general, more volatile assets are considered riskier, providing greater variability in returns and less certainty about expected results. Silver has historically been more volatile due to its relatively small market size and demand, which is dependent on manufacturing and production. The one-year average annual standard deviation of weekly returns for gold and silver highlights silver's higher volatility relative to gold.

When there is a lot of silver

When asked what is heavier, gold or silver, the answer is clear: gold. Therefore, small gold jewelry costs less than medium-sized silver jewelry. The cost of the product (even if it is not a jewelry accessory, but, for example, a household item - silverware) depends on the weight of the product. Traditionally, silver jewelry makes more sense than gold or platinum jewelry.

Massive outlines and heavy semi-precious stones are a classic for evening and business looks. Therefore, often “harmless” semi-precious combinations - for example, a necklace with amber - can cost a lot due to their weight! But the game is worth the candle. After all, such decoration is both bright and universal. The business dress code allows silver. Also keep in mind that household items made of silver (but not silver-plated) also cost a lot. But they also have an undeniable advantage - they improve the status of the home and disinfect food. Therefore, whether gold is heavier than silver or not is not important. Large silver jewelry easily outperforms gold jewelry, and looks bright, stylish and status-worthy.

Still have questions? Leave a request and we will contact you!

Order a consultation

Getting the most out of your precious metal

As 2021 progresses, several factors could continue to drive gains for gold, silver and other commodities. In fact, diversifiers are likely to play an increasingly important role this year in helping investors navigate portfolios amid rising technical risks and changing business cycles. Understanding how each asset can potentially help optimize risk-based performance is vital. For investors who want to manage their portfolios effectively, gold can be an excellent, less volatile source of ongoing diversification.

Posted by Diego Andrade March 15, 2021 | Translation: Gold Reserve

Difference #3: Silver requires much more storage space

All of those accessibility benefits we just talked about come with a catch: silver requires more space to store than gold.

Silver is much less dense: pure silver is 84% more dense by volume than pure gold. This means that silver takes up 128 times more space than gold!

Here are some practical examples of this difference:

- You can hold $50,000 worth of gold in one hand, but it would take about 10 large shoeboxes to hold the same dollar amount of silver.

- $50,000 worth of gold weighs about 2.6 pounds, but the same value of silver weighs about 189 pounds!

- You can store approximately $170,000 in gold in a small safe, but only $2,300 worth of silver will be stored in that same place.

It's relatively easy to hide some gold coins in a sock drawer or cookie jar, but those same hiding places are not suitable for the same silver investments. Whether you're buying coins or bars, you'll need much more storage space for silver than gold.

And because it requires more space, professional storage fees are higher.

This difference also applies to transporting silver, which can be more difficult and expensive.

Lastly, silver will eventually tarnish, so silver coins and bars should be stored in a dry place.

Note to investors : Gold takes up much less storage space than silver, is cheaper to store, lighter and less bulky to transport, and does not change color.

Basic physical and mechanical properties of gold

In addition to specific gravity, the physical and mechanical properties of gold are also important characteristics.

Color. According to this indicator, of all the metals, only gold (yellow) and copper (pinkish-red) have their own special, characteristic color. As for other metals, it is more complicated - for example, white color is characteristic of platinum, silver, aluminum, tin, magnesium and cadmium. In addition, some metals can have different shades - arsenic (grayish), lead (bluish-white). Many metals, when crushed, may have uncharacteristic colors, such as red or brown. In addition, most metals oxidize upon prolonged contact with air and, as a result, they darken.

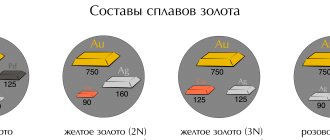

Specific gravity plays an important role not only in gold mining, but also in the production of various alloys. In order for them to be uniform and of high quality, it is necessary to select metals with a slight difference in specific gravity. Otherwise, if the difference is very significant, during fusion the metal, which has a lower volumetric weight than gold, may float.

Only gold and copper of all metals have a special, characteristic and unique color.

Gold turns into a liquid state from a solid at 1095 degrees Celsius.

Specific heat. Denotes the amount of heat that is necessary to increase 1 kilogram of gold by 1 degree Celsius - measured in kilocalories and denoted by the letter C.

Thermal conductivity. This property of a metal to conduct heat is characterized by its thermal conductivity coefficient.

Gold melts at 1095 degrees Celsius.

Hidden melting point. The metal must be heated to the melting temperature and maintained while the crystalline structure is destroyed - until the gold completely transforms into a liquid state. This additional energy is called the latent heat of fusion and is measured in kilocalories.

Electrical resistance - measured in Ohms.

Coefficient of linear expansion (thermal or thermal). Indicates the ability of a metal to increase its size in length (when heated).

Magnetic properties. All metals are divided into: paramagnetic, diamagnetic and pheromagnetic. When introduced into a magnetic field, materials of the diamagnetic group are not attracted to the magnet. Gold is one of the diamagnetic metals.

Indicators of the specific gravity of other metals

Specific gravity is an indicator that is an integral characteristic of other metals.

The specific gravity of silver is affected by the fineness of the alloy. When other metals (copper, nickel) are added to it, the specific gravity and density are lost. Thus, the density of copper is 8.93 g/cm3, nickel – 8.91 g/cm3. All values are calculated using formulas.

You may be interested in: Is it possible to magnetize gold?

Silver is the same noble metal as gold. Its specific gravity is 10.5 g/cm3. It melts at a temperature of 960 degrees. The main physical characteristics of silver are:

- corrosion resistance;

- low resistance;

- increased light reflectivity.

Despite its natural softness, silver has a high density and specific gravity.

Titanium is a non-ferrous metal of a white-silver hue. It has high strength, although it is light in weight. So, it is 12 times stronger than aluminum and 4 times stronger than copper and iron. In terms of the degree of presence in the earth's crust, titanium is given fourth place among the rest.

The low specific gravity of titanium - 4.505 g/cm3 is more consistent with alkali metals. An oxide film forms on its surface, which prevents the formation of corrosion.

Zinc is also a non-ferrous metal with a white-bluish tint. It has medium hardness and an initial melting point of 419 degrees. Under the influence of a temperature of 913 degrees, this metal acquires a vaporous state. Zinc has a specific gravity of 7.13 g/cm3.

Normal temperature makes zinc brittle, but increasing it to 100 degrees makes the metal flexible and ductile. When interacting with air, an oxide film forms on the surface of zinc.

The color of lead is dirty gray, but this does not affect the natural shine of the metal. However, the glow stops quite quickly due to the formation of an oxide film on the surface of the lead. The lead alloy has a high specific gravity - 11.337 g/cm3. In this indicator, it exceeds zinc, aluminum, iron and some other metals. Despite its high density, lead is a very soft metal.

It is easy to knead in your hands or scratch with your nails. For lead, a temperature of 327.5 degrees is enough for it to begin to melt.

The table shows the specific gravity and melting points of other metals.

You may be interested in: What is “Royal Vodka” in chemistry and how can you prepare it yourself?

| Name of metal | Melting point, °C | Specific gravity, g/cc |

| Zinc | 419.5 | 7.13 |

| Aluminum | 659 | 2.69808 |

| Lead | 327.4 | 11.337 |

| Tin | 231.9 | 7.29 |

| Copper | 1083 | 8.96 |

| Titanium | 1668 | 4.505 |

| Nickel | 1455 | 8.91 |

| Magnesium | 650 | 1.74 |

| Vanadium | 1900 | 6.11 |

| Tungsten | 3422 | 19.3 |

| Chromium | 1765 | 7.19 |

| Molybdenum | 2622 | 10.22 |

| Silver | 1000 | 10.5 |

| Tantalum | 3269 | 16.65 |

| Iron | 1535 | 7.85 |

| Gold | 1095 | 19.32 |

| Platinum | 1760 | 21.45 |